Deep Packet Inspection Market Revenue, Share Analysis | 2035

The global Deep Packet Inspection (DPI) market is characterized by a level of competitive intensity that reflects its critical role as the enabling technology for both network security and intelligent traffic management. Competition in this space is not a simple, one-dimensional rivalry but a multi-layered phenomenon that unfolds across numerous fronts, from raw processing performance and the accuracy of application identification to the flexibility of deployment models and the ability to handle encrypted traffic. The high strategic importance of network visibility has created a hyper-competitive environment where the stakes are immense and the pace of technological innovation is relentless. A thorough market research study of the Deep Packet Inspection Market Competition is crucial for understanding the forces that are shaping the industry, the key battlegrounds where vendors are vying for differentiation, and the likely trajectory of the market's evolution. The nature of competition has fundamentally shifted from offering a basic classification engine to providing a high-performance, AI-enhanced intelligence layer for the most demanding network environments.

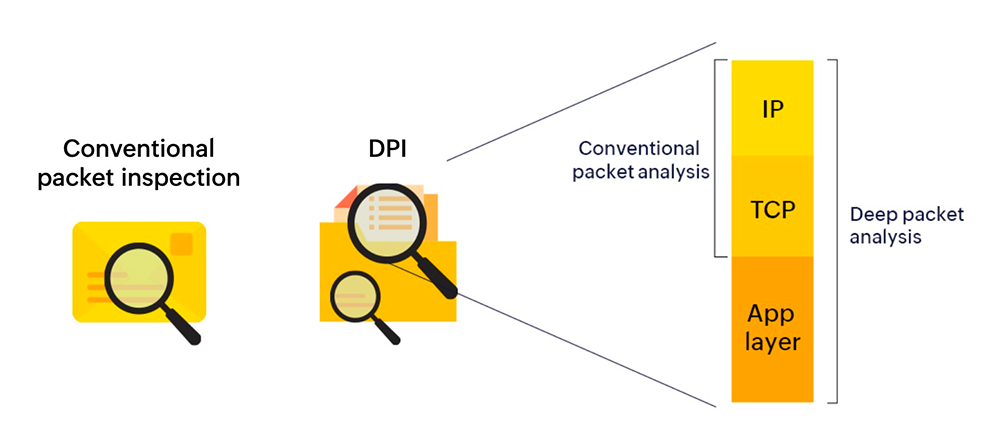

A deep analysis of the competitive landscape highlights several key battlegrounds where this rivalry is most intense. The most significant is the ongoing war over performance, measured in terms of throughput (Gbps/Tbps), latency, and the number of concurrent flows a solution can handle. This is particularly fierce in the service provider market, where DPI must operate at line rate in massive core networks. Another critical competitive front is the accuracy and granularity of the application signature library; vendors compete on the number of applications they can identify, the frequency of their signature updates, and their ability to detect evasive applications and traffic that uses non-standard ports. The ability to inspect and classify encrypted SSL/TLS traffic without imposing a significant performance penalty is arguably the most important differentiator in the modern market. Furthermore, there is intense competition between vendors offering standalone, best-of-breed DPI solutions and large security vendors who integrate DPI as a feature within their broader next-generation firewall (NGFW) or SASE platforms, creating a "good enough" challenge for the specialists.

The strategic levers that companies are using to compete have also become more sophisticated. While hardware appliances are still relevant, the key competitive differentiator is now the software, with vendors competing on the efficiency of their code and their ability to run on a wide variety of commercial off-the-shelf (COTS) hardware and virtualized environments. Pricing models have largely shifted from perpetual hardware licenses to more flexible subscription-based software licenses, often tied to throughput or the number of subscribers. The Deep Packet Inspection Market size is projected to grow USD 10.2 Billion by 2035, exhibiting a CAGR of 6.02% during the forecast period 2025 - 2035. A vendor's ability to provide a clear and easy-to-use management interface with powerful analytics and reporting capabilities has also become a major factor in purchasing decisions. Ultimately, competition in the modern DPI market is a multi-dimensional game where success depends not only on building a fast engine but also on providing accurate intelligence, handling encryption, and offering a flexible, software-centric business model.

Top Trending Reports -