North America Treasury Software Market Size, AI Integration Impact, and Strategic Analysis Forecast 2032

"Executive Summary North America Treasury Software Market: Growth Trends and Share Breakdown

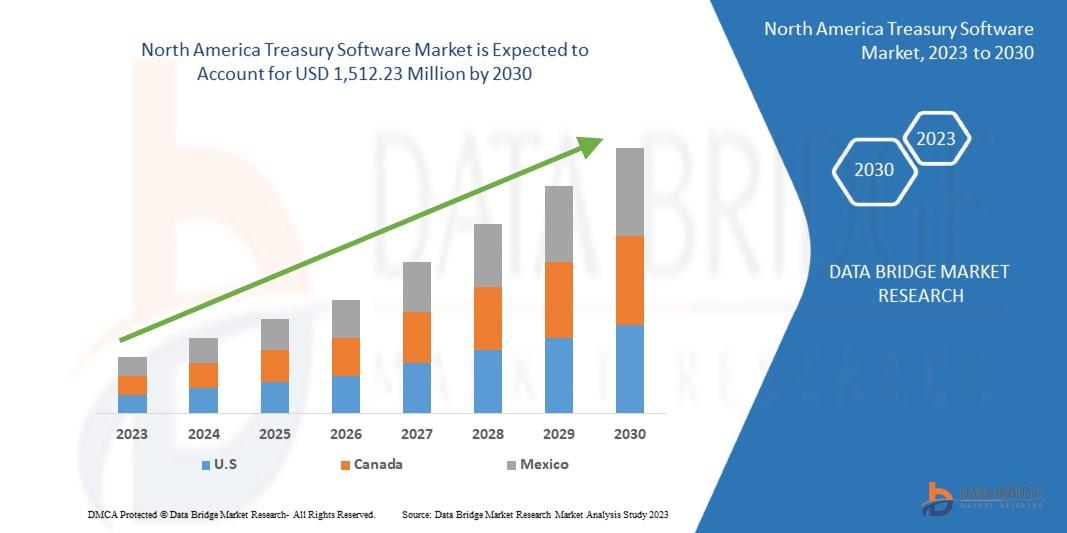

Data Bridge Market Research analyses that the market is growing with a CAGR of 3.3% in the forecast period of 2023 to 2030 and is expected to reach USD 1,512.23 million by 2030.

This global North America Treasury Software Market research report is organized by collecting market research data from different corners of the globe with an experienced team of language resources. As market research reports are gaining immense importance in this swiftly transforming marketplace, North America Treasury Software Market report has been created in a way that you anticipate. Keeping in mind the customer requirement, this finest market research report is constructed with the professional and in-depth study of North America Treasury Software Market industry. It all-inclusively estimates general market conditions, the growth prospects in the market, possible restrictions, significant industry trends, market size, market share, sales volume, and future trends.

This North America Treasury Software Market research report is formed with a nice combination of industry insight, smart solutions, practical solutions, and the newest technology to give a better user experience. Data collection modules with large sample sizes are used to pull together data and perform base year analysis. To perform this market research study, competent and advanced tools and techniques have been used that include SWOT analysis and Porter's Five Forces Analysis. This North America Treasury Software Market report gives information about company profile, product specifications, capacity, production value, and market shares for each company for the years under the competitive analysis study.

Get a full overview of market dynamics, forecasts, and trends. Download the complete North America Treasury Software Market report: https://www.databridgemarketresearch.com/reports/north-america-treasury-software-market

North America Treasury Software Market Summary

Segments

- On the basis of deployment, the North America treasury software market can be segmented into on-premises and cloud-based solutions. The growing adoption of cloud-based software solutions is driving significant growth in the market as organizations are increasingly migrating towards more flexible and scalable options that provide remote accessibility and cost-efficiency. Cloud-based treasury software offers enhanced security features and easier updates, making it a popular choice among businesses looking to modernize their financial operations.

- In terms of application, the market can be divided into cash management, risk management, payment management, and compliance management. Cash management solutions help organizations streamline their cash flows, optimize liquidity, and improve financial decision-making. Risk management software offers tools to identify, assess, and mitigate financial risks, helping companies protect themselves against market fluctuations and uncertainties. Payment management systems enable secure and efficient payment processing, while compliance management software ensures adherence to regulatory requirements and standards.

- Based on organization size, the North America treasury software market is categorized into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly recognizing the value of treasury software in helping them automate manual processes, improve accuracy, and enhance overall financial performance. Large enterprises, on the other hand, are investing in advanced treasury solutions to manage complex financial operations, achieve better visibility and control, and drive strategic decision-making.

Market Players

- Some of the key players operating in the North America treasury software market include Oracle Corporation, SAP SE, Finastra, Kyriba, GTreasury, ION Group, TreasuryXpress, Bottomline Technologies, Salmon Software, and Bellin. These market players offer a wide range of treasury software solutions tailored to meet the diverse needs of organizations across various industries. They focus on innovation, strategic partnerships, and continuous product enhancements to stay competitive in the market and address evolving customer requirements.

- The North America treasury software market is highly competitive, with vendors vying for market share through product differentiation, pricing strategies, and customer service. Market players are also investing in research and development to introduce advanced features such as artificial intelligence, machine learning, and predictive analytics into their solutions to help organizations optimize cash management, reduce financial risks, and enhance operational efficiency.

The North America treasury software market is experiencing notable growth driven by various factors such as digital transformation initiatives, increasing focus on financial automation, and the need for enhanced risk management capabilities. One emerging trend in the market is the integration of advanced technologies like AI and machine learning to provide more intelligent and efficient treasury solutions. These technologies enable software platforms to analyze vast amounts of financial data, detect patterns, and generate insights that can help organizations make better decisions and optimize their cash management processes. As businesses strive to improve financial visibility, compliance, and overall operational efficiency, the adoption of next-generation treasury software solutions is expected to continue to rise.

Another key aspect impacting the market is the shift towards mobile treasury solutions, allowing users to access critical financial data and perform transactions on the go. Mobile applications offer greater flexibility and convenience, enabling treasury professionals to stay connected and make informed decisions in real-time, regardless of their location. This trend is particularly significant in today's fast-paced business environment, where agility and responsiveness are essential for effective cash management and risk mitigation. Market players are increasingly focusing on developing user-friendly mobile interfaces and secure mobile payment functionalities to cater to the evolving needs of their customers.

Furthermore, regulatory compliance remains a significant driver shaping the North America treasury software market landscape. As financial regulations continue to evolve and become more stringent, organizations are compelled to invest in robust compliance management solutions to ensure adherence to rules and standards. Treasury software providers are enhancing their offerings to include features that facilitate regulatory reporting, monitoring, and audit trails, enabling businesses to navigate complex compliance requirements effectively. This heightened focus on compliance underscores the importance of having comprehensive treasury software solutions that not only streamline financial processes but also mitigate legal and regulatory risks.

Lastly, the market is witnessing a growing demand for customizable and scalable treasury software solutions to meet the unique requirements of different organizations. Businesses are seeking adaptable software platforms that can be tailored to their specific needs, whether in terms of cash forecasting, risk assessment, or payment processing. Market players are responding to this demand by offering flexible deployment options, modular functionalities, and customizable features that empower users to configure the software according to their distinct workflows and objectives. This trend highlights the increasing emphasis on personalized financial technology solutions that empower organizations to optimize their treasury operations in alignment with their strategic goals and business priorities.The North America treasury software market is a dynamic and evolving landscape driven by various factors influencing the industry's growth trajectory. One notable trend shaping the market is the increasing adoption of cloud-based solutions. Organizations are increasingly recognizing the benefits of cloud-based treasury software, such as remote accessibility, scalability, enhanced security features, and cost-efficiency. The shift towards cloud deployments reflects a broader trend towards digital transformation and the modernization of financial operations across industries.

Moreover, the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML) is another significant trend in the North America treasury software market. These technologies enable software platforms to analyze vast amounts of financial data, identify patterns, and generate insights to facilitate better decision-making and optimize cash management processes. The incorporation of AI and ML capabilities in treasury software solutions underscores a move towards more intelligent and efficient financial operations, supporting organizations in improving financial visibility, compliance, and overall operational efficiency.

Mobile treasury solutions are also gaining prominence in the market as businesses prioritize agility and responsiveness in their financial operations. The availability of mobile applications allows treasury professionals to access critical financial data, conduct transactions, and make informed decisions in real-time, irrespective of their location. The trend towards mobile treasury solutions aligns with the need for greater flexibility and convenience in today's fast-paced business environment, where timely decision-making is crucial for effective cash management and risk mitigation.

Furthermore, regulatory compliance continues to be a significant driver shaping the North America treasury software market. With evolving financial regulations and increasing regulatory scrutiny, organizations are under pressure to invest in robust compliance management solutions to ensure adherence to rules and standards. Treasury software providers are enhancing their offerings with features that facilitate regulatory reporting, monitoring, and audit trails, enabling businesses to navigate complex compliance requirements effectively. The emphasis on compliance underscores the importance of comprehensive treasury software solutions that not only streamline financial processes but also mitigate legal and regulatory risks.

Lastly, there is a growing demand for customizable and scalable treasury software solutions tailored to the unique requirements of different organizations. Businesses are seeking adaptable software platforms that can be customized to align with their specific cash forecasting, risk assessment, and payment processing needs. Market players are responding to this demand by offering flexible deployment options, modular functionalities, and customizable features that empower users to configure the software according to their distinct workflows and strategic objectives. This trend highlights the increasing focus on personalized financial technology solutions that enable organizations to optimize their treasury operations in alignment with their business priorities and goals.

Examine the market share held by the company

https://www.databridgemarketresearch.com/reports/north-america-treasury-software-market/companies

Nucleus is Data Bridge Market Research’s cutting-edge, cloud-based market intelligence platform that empowers organizations to make faster, smarter, data-driven decisions. Designed for strategic thinkers, researchers, and innovators, Nucleus transforms complex macroeconomic indicators, industry-specific trends, and competitive data into actionable insights through dynamic dashboards and real-time analytics. With capabilities spanning market access intelligence, competitive benchmarking, epidemiological analytics, global trade insights, and cross-sector strategy modeling, the platform unifies diverse datasets to help businesses identify opportunities, assess risks, and drive growth across regions and industries. Built on a powerful neural analytics engine, Nucleus bridges the gap between raw data and strategic execution, enabling users to visualize emerging trends, benchmark performance, and make informed decisions with confidence.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/asia-pacific-treasury-software-market

North America Treasury Software Market Research Questionnaire – 25 Sets of Analyst Questions

- What is the estimated revenue of the global North America Treasury Software Market?

- What are the future growth projections for the North America Treasury Software Market?

- What are the major types and applications in the North America Treasury Software Market segmentation?

- Who are the major companies analyzed in the North America Treasury Software Market report?

- Which country-level data is included in theNorth America Treasury Software Market research?

- Which organizations hold significant influence in the North America Treasury Software Market?

Browse More Reports:

Asia-Pacific Unmanned Surface Vehicle (USV) Market

Europe Treasury Software Market

North America Recovered Carbon Black (rCB) Market

Asia-Pacific Golf Apparel, Footwear, and Accessories Market

Europe Corrugated Box Market

Europe Architectural Coatings Market

Global Men’s Health Market

Global Disinfectant Wipes Market

Global Medical Plastic Market

Global Testosterone Replacement Therapy Market

Global Recycled Plastic Market

Global Collagen Drinks Market

Global Tire Material Market

Global Total Lab Automation Market

Global Gallium Nitride (GaN) Powered Chargers Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"