Payment Processor Market Segmentation & Forecast : Share, Size, and Growth Insights

Global Payment Processor Market: Trends, Growth Factors, and Future Outlook

The Global Payment Processor Market is undergoing rapid transformation as digital commerce, financial technology innovations, and mobile payments reshape how consumers and businesses transact. Payment processors act as the backbone of the global payments ecosystem, enabling secure and seamless transactions across online, mobile, and in-store channels. As digitalization accelerates and cashless payments rise, the demand for efficient payment processing solutions is expected to grow significantly.

Get More https://www.databridgemarketresearch.com/reports/global-payment-processor-market

Market Overview

Payment processors are companies that handle the technical and secure transfer of funds between customers, merchants, and banks. With increased internet usage, smartphone penetration, and the rise of e-commerce, payment processing has become a key driver of the global digital economy.

In recent years, the market has experienced strong growth due to:

-

Expansion of online businesses and marketplaces

-

Adoption of contactless and mobile payments

-

Increased demand for real-time and cross-border payments

-

Growth of fintech startups and digital wallets

-

Rising government initiatives for digital financial inclusion

Key Market Drivers

1. Surge in Digital Payments

Consumers worldwide are shifting from cash to digital payment options such as mobile wallets, QR payments, and online banking. This trend has boosted the need for advanced payment processing systems that ensure speed, accuracy, and security.

2. Growth of E-commerce and Online Services

The rapid growth of the e-commerce industry, fueled by convenience and global accessibility, has created an enormous opportunity for payment processors. Online retail requires quick, fraud-protected, and user-friendly payment solutions.

3. Increasing Adoption of Fintech

Fintech companies have introduced innovative payment products such as digital wallets, peer-to-peer payments, and subscription-based platforms. These technologies rely heavily on secure payment gateways and processors.

4. Emphasis on Security and Fraud Prevention

As transaction volumes rise, so does the risk of cybercrime. This has led to increased investment in secure payment processing, encryption, tokenization, and authentication technologies.

5. Growth in Cross-Border Transactions

Globalization has led to a rise in international payments for trade, travel, and online services. Payment processors offering fast, low-fee cross-border solutions are in high demand.

Market Challenges

Despite strong growth, the market faces challenges such as:

-

High risk of cyber threats and data breaches

-

Complex regulatory compliance across countries

-

High transaction costs for some payment methods

-

Competition from emerging technologies like blockchain

Segmentation Overview

By Payment Method

-

Card Payments

-

Digital Wallets

-

Bank Transfers

-

Mobile Payments

-

Cryptocurrency Payments (emerging segment)

By End User

-

Retail and E-commerce

-

BFSI (Banking, Financial Services, Insurance)

-

Hospitality and Travel

-

Healthcare

-

Telecom and IT

-

Government and Public Sector

By Deployment

-

Cloud-based Payment Processing

-

On-premises Processing

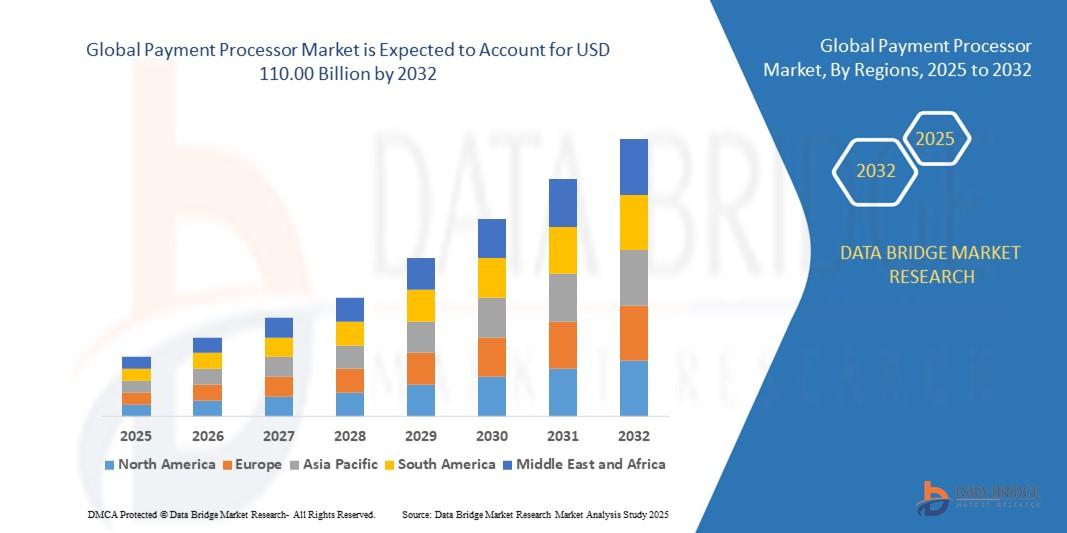

Regional Insights

North America

A leading region driven by advanced financial infrastructure, high consumer awareness, and strong fintech growth.

Europe

Emphasis on security, regulations, and digital banking initiatives increases adoption of payment processing technologies.

Asia-Pacific

One of the fastest-growing markets due to smartphone penetration, digital wallets, and government-led digitalization.

Latin America & Middle East

Growing internet usage and expanding retail sectors are key drivers.

Future Outlook

The future of the Global Payment Processor Market looks highly promising. The market is expected to expand with innovations such as:

-

Real-time payment systems

-

AI-driven fraud detection

-

Blockchain-based processing

-

Biometric authentication

-

Open banking APIs

As businesses continue to move toward digital-first strategies, payment processors will play a crucial role in ensuring smooth and secure financial transactions.

Get More Report

Global Payment Processor Market

Global Small Domestic Appliances (SDA) Market

Global Premium Chocolate Market

Europe Cleanroom Technology Market

Global Compressed Natural Gas (CNG) Market